Money…

It’s a touchy subject for many of us, even during the best of times. And right now, being that many people are out of work due to the current state of shut-down worldwide, it’s even more of a potential landmine.

But financial health is a thing, right?

And how well we are set up to handle the current economic stresses is telling.

When I set out to write under the general umbrella of Health/y/ness for this year’s A-to-Z Blogging Challenge, I originally thought I’d be writing a different kind of post. (‘I’ is for Investing? ‘M’ is for ‘Mad Money’? I dunno… Something.) But since the global situation is what it is, I thought maybe it would be a better idea to share a few practical (and easily practice-able!) money-saving tips that have helped me over the years and invite you to do the same. Perhaps what you read here will be things you already do; maybe the ideas will be new. Either way, thriftyness is never amiss!

♦

CONTENT NOTE: This post is about money and the management/spending thereof. It touches on childhood financial education, troubled family dynamics, and poverty before discussing lessons learned. The tips shared in this post are NOT ADVICE. It is not my desire to be prescriptive; my intent is simply to share my own experiences. Given the current economic distresses and monetary anxieties people are likely feeling as a result, it is totally understandable if you’d prefer to give this one a miss. And if you’d prefer to just skip to the Thrifty Tips, scroll down to the section titled thus.

Personal History

I was raised by a woman who was raised by a woman who was orphaned during the Great Depression. As a result of this upbringing, my mother – who then passed along her ‘knowledge’ to me – was a weird mixture of strictness and helter-skelter panicked thinking where money was concerned.

From the time I first starting receiving money as a child – which was… I dunno, age four or five? – my mother’s expectation was that I put my money in the bank.

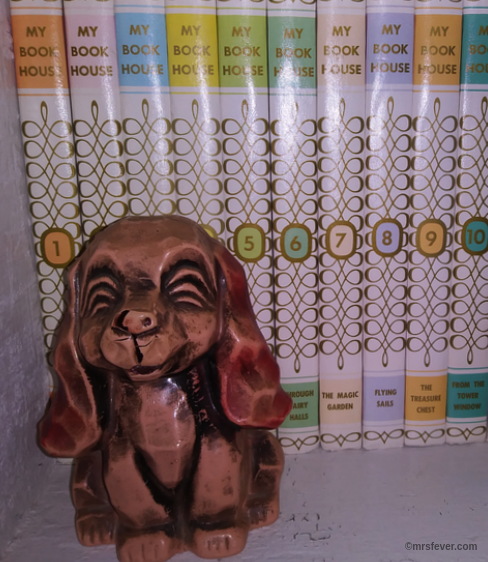

I had a little celluloid puppy dog bank (which I still have, actually — and it still has money in it!) at first, then later I acquired a larger ceramic bank. Mostly, I didn’t have much money. I mean: obviously. Right? But I started earning an allowance ($2 per week!) at around age six (and it was earned; I did plenty of chores) and would sometimes have a car wash to raise money for summer camp, and I started babysitting when I was nine. So there was some. Pretty much, the coins went in the little bank and the dollar bills went in the bigger bank, and when the time came to roll coins or empty the bills, they got taken to our local savings bank, where my little passbook savings account would grow in Really Big Giant Huge Increments, like $17.75 at a time.

*smile*

Funny how far $17.75 used to go, too.

Ah, nostalgia.

Anywhoo…

So my money went into my little account at the savings bank, and then when it was needed for something – and ‘need’ is the key word; ‘want’ has very much become conflated with ‘need’ these days and there is a huge difference – there was much ceremony in terms of getting my funds withdrawn.

And that’s how things went, really. There wasn’t much discussion about it. The expectation was set; I followed it. It never really occurred to me that my mother would have done anything different with her own money. It never occurred to me to think about my mother’s money at all, actually. Other than the fact that she used coupons when we went grocery shopping, purchased our school clothes only when they were on sale, and never bought anything for herself unless it was absolutely necessary, I don’t think I knew much about my mother’s financial situation.

Until she got divorced.

Because then it became abundantly clear that her monetary situation amounted to this: she had no money.

What the…

WHY?

Well, because even though she had worked throughout her marriage, the bank account was joint and he had control. Which meant he had control to empty it. And he did.

So it was at that point that my mom started working two jobs while we (there were four of us: mom, me, my brother, and my sister) lived in a tiny bedroom that was lent to us while I – at the age of 12 – took partial financial responsibility for our family, emptying my bank account (all those under-$20 deposits added up to enough hundreds to make a difference in the ’80s) a little at a time to help pay for things like milk and eggs and cereal and diapers (my little sister was only two years old) and calamine lotion and bandages.

Having already been schooled in family-style cooking (part of my chores – the ones I earned my $2 allowance for – was to help make dinner twice a week) and knowing how to bake, I learned to tweak the recipes I knew to fit the available ingredients in my cupboards. I learned how to price things, how to find the ‘real’ cost of an item to figure out which size/brand/item was the better deal, and how to squeeze blood from pennies.

Some of those pennies, after all, were my own.

And y’know…

I don’t really talk about my family or my childhood very often. Not in real life, and most definitely not on this blog.

And it’s not because it didn’t affect me.

It’s just that it’s complicated. And it’s extremely easy for people to misunderstand. (Or to judge, without knowing the whole story.)

It’s also easiest to just… I dunno… Leave the past in the past, I guess.

But my past very much comes into play in my present where money is concerned.

♦

Lessons Learned

Being thrown into a very adult role at a sensitive age, I learned to take money very seriously, but also how to be happy without it.

This meant that when I went away to college (via scholarships and loans — I paid for my entire degree myself, thankyouvermuch), it didn’t bother me to work – sometimes multiple jobs concurrently – while I went to school, and did not feel like I was missing out on things I couldn’t afford socially, because I knew that:

- work = paycheck, and paycheck = tuition, which in turn became

- tuition = degree, and degree = better financial future*

*No, I was not a math major. 😉

It meant that during (and after) college, continuing to this day, I:

- do my damnedest not to pay full price for anything, ever

- cook and bake my own meals and treats often, rather than paying three times the amount and eating out

- shop with “saving money” in mind

- choose services that require recurring billing wisely, and willingly go without those types of things even when the rest of the world believes they are ‘necessary’

Yes, I do eat restaurant food. I just don’t eat it all the time.

And yes, I do splurge on things. But it’s only when it’s a well-planned-and-saved-for splurge, and only for damn good reason.

No, I am not a cheapskate. If an item is worth it, I will pay for it. But many things are not worth their pricetag and/or can be had at a lesser cost, and I will always look for that.

Confused?

If you are, no worries.

I’m gonna break those concepts down a bit for you so you can see how I get my thrift on. 🙂

Thrifty Tips

When it comes to not paying full price for things and shopping with “saving money” in mind, here are some things that work for me:

Buying Secondhand: I am not afraid of previously-loved merchandise. Having grown up as the recipient of older cousins’ and church acquaintances’ hand-me-down clothing, I suppose I could have developed an aversion to the idea, but I’m just not that kind of person. I appreciate quality goods whether they are brand new or not, and if they are in good condition, I am happy to purchase things like clothing, furniture, household decor, tools, and machinery second-hand. I bought a red leather couch ten years ago for $60 that still adorns my work space; a 1960s pole tension lamp that I got for $1 (one dollar!) at an auction stands next to “my” chair in the living room; one of my husband’s workbenches ($20 — a steal!) in the garage came from an estate sale. Half my wardrobe is from resale shops; antique stores, estate sales, and secondhand charity shops furnished me with the majority of my kitchen goods. And all at a great price!

Shopping With Coupons: People inevitably think of groceries when you mention coupons, but I shop with coupons at retailers like Kohl’s and Macy’s** as well as when I’m shopping for… erm… sexier goods. (I only paid 50% of retail for my Fun Factory ‘fun’, for example.) I look for advertised discounts in my local paper and comb through my local mailers for coupons on things like oil changes and pizza delivery and outings/events year-round. I also take advantage of members-only discounts at places that offer them (think: every tenth entree is free when you use Restaurant Whatever It’s Called’s punch card) and if I am shopping someplace that I have no coupons on hand for, I ask an associate. (“Isn’t there a coupon out right now?” has saved me 25% or more multiple times.)

**Mommy Saves Big is my go-to website for these kinds of discounts.

Cooking and Baking: In all honesty, cooking holds very little appeal for me. (Baking is much more My Thing™. I’m conscientious about money as well as ingredients. You can read about some of my no-waste conscious baking here and here.) But I *do* cook. Because to pay a restauranteur to do it just makes no sense to me. I can make a stir-fry at home for less than $3 (cost of ingredients). Why would I spend $13 for someone else to make it?

Frugal Grocery Shopping: I have access to a local discount grocer who purchases overstock and previous-season goods from suppliers and unsold merchandise from competitors. Their stock always varies, but I am able to get things like:

-

- still-good yogurt that has the ‘old’ logo on it

- perfectly good cereal that happens to have last month’s box design

- Christmas M&Ms in January (so what if they’re red and green?)

- my preferred brand of cat litter in a box size that’s been discontinued

I also shop ‘regular’ grocery stores with price-per-unit in mind. Sometimes, for example, a small jar of peanut butter will be on sale at 2/$5 (two for five dollars). The large jar of peanut butter, however, will contain the same number of total ounces that two small jars would, and it’s only $3.99. Since peanut butter is a staple in my household, especially for baking, I’m gonna go with the large jar even though it seems like it costs more ($2.50 vs $3.99) because the price-per-ounce is actually less.

And I’ll look at overall price/worth-it-ness when buying non-staples. Maybe, for example, there is a 12-pack box of granola bars that is a better cost-per-unit price than the 6-pack box. But it takes us a long time to eat our way through a box of granola bars. So if the 6-pack costs $2 and the 12-pack costs $3.50, I’m still gonna go with the 6-pack. If that makes sense.

It’s strategy.

For recurring-billing items, I have a strategy as well.

Mostly, that strategy is: Nope, not gonna pay for that!

*laugh*

But no, seriously…

I use my phone for work, but I run most of my phone functions off wi-fi and have no need of fancy fone-ness, so I refuse to pay for equipment or data I don’t need. There’s a $200/month payment plan for the most recent i-Cult item? No thanks. I’ll pay $200 once, straight out (not on a year-long payment plan), and it’ll last me four years. The unlimited plan is “only” $149? No thanks. I only need 2 gigs of data per month (and I don’t actually even need that much) and that costs $99.

Things like cable TV? Oh hell no. I’m not paying for that. It’s all commercial (and don’t get me started on how detrimental commercials can be) and it costs upwards of $150/month. If I’m gonna spend $150 per month on ‘entertainment’ (and to be clear, I do not think television is ‘entertaining’), I’ll buy books. And if I want something to watch, I will choose something from my DVD collection. Most of which has been purchased – hella cheap! – secondhand.

Which brings us back to where this section started.

Heh.

‘Kayso…

♦

Now YOU!

Have you learned any valuable lessons in thrift? What do you do to make your dollars stretch farther?

Whether you feel you’re in a healthy place right now where money is concerned or are just trying to make it through – one day at a time – your insight is valuable. Please share your own thoughts and experiences in the comments below!

April A-to-Z Blogging Challenge: Letters TUVW

If you are reading my blog you will see my grandmother didn’t have any money to spare. Nor did my mother whose husband died when I was 10. I suppose the most important thing I learnt was not to waste food. Being able to use leftovers in a new form became an art form. While my husband and I were working (teachers) with two children, there never seemed to be any spare money but we did always manage to have a sailing boat and later a caravan. Now we are retired there is no threat of losing our job and we have less money worries than before thanks to a good teachers’ pension. We have had home delivery for our birthdays but everything else has been prepared at home. We were in the habit of having coffee with our fellow aquajogging friends after the morning workout. Now that has gone and we make excellent espresso at home. So much money saved! We still catch up on Zoom Fitness classes and share a coffee on FaceTime. Not sure I’d want to do it forever but we are so lucky compared to people doing it tough.

Yes, I am reading your blog. I’m a little nervous for Ruby in her new “family” situation — very curious to see how that turns out!

And you make a great point about leftovers! Turning last night’s leftovers into today’s lunch calls for kitchen creativity!

Great post Fev. I can relate to a lot of what you wrote. I grew up in the 50’s, post war, with parents that come through the Great Depression. Living on the country edge of town, growing fruit and vegetables was very much the norm, and the Vacola preserving set was in constant use. As a child, I minced tomatoes to make our own sauce/ketchup and soup. I sliced beans for preserving, as well as peeling and slicing fruit for preserving.

In later life, I was fortunate to have well paying jobs, but saving “for a rainy day” was always in mind. I learned the Bible story of Joseph directing the Egyptian pharaoh to store up grain for seven years in preparation for the coming famine.

With a lot of my work being contractual with no explicit holiday, sick pay or long service leave, putting aside was essential. An essential part of that was paying house mortgage payments forward, so that when unemployment came, we could negotiate reduced monthly payments until better times. After the Y2K bubble, work dried up and I was unemployed for almost 2 years.

I saddens me to see family and friends that essentially spend every thing they earn, even if not week-to-week, at least with annual overseas holidays, the latest cars and technology. Then COVID-19 hits and they cry poor because they can’t pay their phone/internet or utility bills.

Sir Thomas recently posted…Q – Question (#AtoZChallenge)

Preserving — yes! My mom has always “put up” stores (canning and freezing) of veggies and fruits. She still makes jams and jellies, applesauce and apple butter, tomato sauces (pasta sauce, pizza sauce, salsa, and ketchup), and preserves fruits and vegetables. I think that was one of the reasons why we went without money but never without food. The fact that the base produce came from our own garden made it very affordable in those days. She also sewed, so many of our clothes were home-made. Nowadays, gardening and sewing have become expensive hobbies compared to the once-thrifty necessities they once were. But looking back, I can see that when I was growing up, they were lifesavers.

I’m self-employed, so I understand what you mean about work being contractual and not having paid time off. Savings is important. Unfortunately, it’s often not something people see the need for until something like this (‘this’ being the current economic shutdown/cutback due to quarantine measures) happens.

We didn’t have much money when I was young so I learned the value of it, which I count as a blessing. My twin sister and I were really lucky, we had lovely clothes because there was another set of twins in our little village a few years older than us and their mother gave my mother all their hand-me-downs and they were loaded. When I was a teenager I used to love jumble sales too – so many barely worn clothes for pennies.

I am a habitual bargain hunter – I don’t do the coupon thing, but I do, do the offer thing. When I wander around the supermarket I have an eye out for the multi-buys and the discounts. My husband has been doing the shopping during this crisis because I can’t stand for long periods and there’s lots of queuing at the moment and he’s not so good at bargain hunting ;). He is fab at money handling though – he has spreadsheets and everything. When we were first married we only had his salary because I was finishing my PhD so we had to be thrifty – that habit stuck even though we are pretty well off these days. I mean we do splurge sometimes, but we refuse rack up debt – we save for things first. We’re luck to be able to.

Tasha 💖

Virginia’s Parlour – The Manor (Adult concepts – nothing explicit in posts)

Tasha’s Thinkings – Vampire Drabbles

Tasha Duncan-Drake recently posted…AtoZ2020 – R is for Ritual & Episode 3 – #AtoZChallenge

I think most people who have experienced the need for thrift and are able pick up a knack for it… It sticks. 🙂

My husband – bless him – is not a bargain hunter. He’s always asking me, “Is this a good deal?” Both for things that are and things that obviously aren’t. It’s easier when he can see lots of the same thing, but different brands, laid out all together. Like in the bread aisle at the grocery store where $2 wins over $6 for a loaf. Otherwise… Nope, he’s pretty clueless about ‘deals’. *laugh* But he’s great company on a shopping excursion. 🙂

You knew I’d love that Red Riding Hood set, didn’t ya ?

It’s a conspiracy , that’s what it is.

|Ahem|

Moving on…..

Growing up with no money teaches one to have respect for it, that’s very true.

Ummm…

Where’d you get that RR Hood?

I’m just asking…. ya know.,

… it’s not like vintage Cookie Jars are any longer an obsession of mine…..

but, after that future lingerie post I promised, there’s gonna have to be some jars.

I knew you’d like that! 🙂

I got the jar online actually — and it’s a candy jar, so smaller than a cookie jar. It’s the only one I’ve ever seen with her basket in front of her instead of over her arm!

I grew up with parents who had to turn every penny over twice, before spending it, and heard ‘no’ many times in my life when I wanted something. When I started working, I already had a kid and my salary wasn’t high. I couldn’t afford meat, but I could cook us healthy meals. I am in a much better place financially now than I have been for many years in my life, and I know that if I have to, I will be able to live with little money again. Experience… I think so. We save as much as we can, while also allowing ourselves some luxuries.

Rebel xox

Oh yes, I’m all too familiar with “NO” being the only answer from parents.

I have tried very hard because of that to tell *myself* “YES” whenever possible because of that. I work hard, I save my money, and when I can afford things, I do them.